How to Accurately Track Mileage for Tax Deductions

Accurate mileage tracking is the backbone of any good business that uses vehicles. Just by recording and reporting mileage correctly, you’re maximizing your tax return, ensuring that you’re compliant with the IRS and have accurate data for additional purposes, including budgeting and insurance.

But to make that happen, you’re required to keep records as proof of your deductible mileage. So every year, businesses and self-employed individuals use all kinds of tools, from manual logs to advanced, almost fully automated mobile apps, to reduce their yearly taxable income thanks to mileage tax deduction. Each trip and each mile driven for business purpose has to be accounted for. And in some cases, even individual expenses such as gas, parking, and repair have to be reported to get a full tax deduction.

So, in order to help you run your business in the most safe and efficient way, we’ll guide you through the best ways to track and report mileage according to the latest IRS regulations.

Let’s see how much you can get back in your mileage tax deduction.

Mileage Tax Deductions

Mileage tax deductions are a simple way to reclaim some of the costs of using your vehicle for business, charitable, and medical purposes. Every time you use your vehicle for those purposes, you may record mileage and reduce taxable income, lowering your tax liability.

What types of travel purposes count as deductible?

- Business purposes include all work-related travel, business meetings, client visits, and other work-related activities. (67 cents per mile in 2024)

- Charitable purposes include driving for a qualified charitable organization and other volunteering activities. (14 cents per mile in 2024)

- Medical purposes include trips to doctors, therapy etc. (21 cents in 2024)

- Moving-related travel applies only in the case of active-duty members of the Armed Forces. (21 cents in 2024)

It’s fair to say that accurate mileage tracking means maximizing your earnings by minimizing your taxable income. But to correctly file for the mileage tax deduction, you need to be certain that you’re eligible and that you digitally or manually keep track of all eligible miles driven.

IRS Guidelines for Mileage Deductions

According to the IRS regulations, you can claim a mileage tax deduction if you’re self-employed or run a business, as long as you don’t itemize deductions.

For 2024, IRS-set mileage tax deduction rates are:

- 67 cents per mile for business purposes.

- 14 cents per mile for charitable purposes.

- 21 cents per mile for medical and moving purposes.

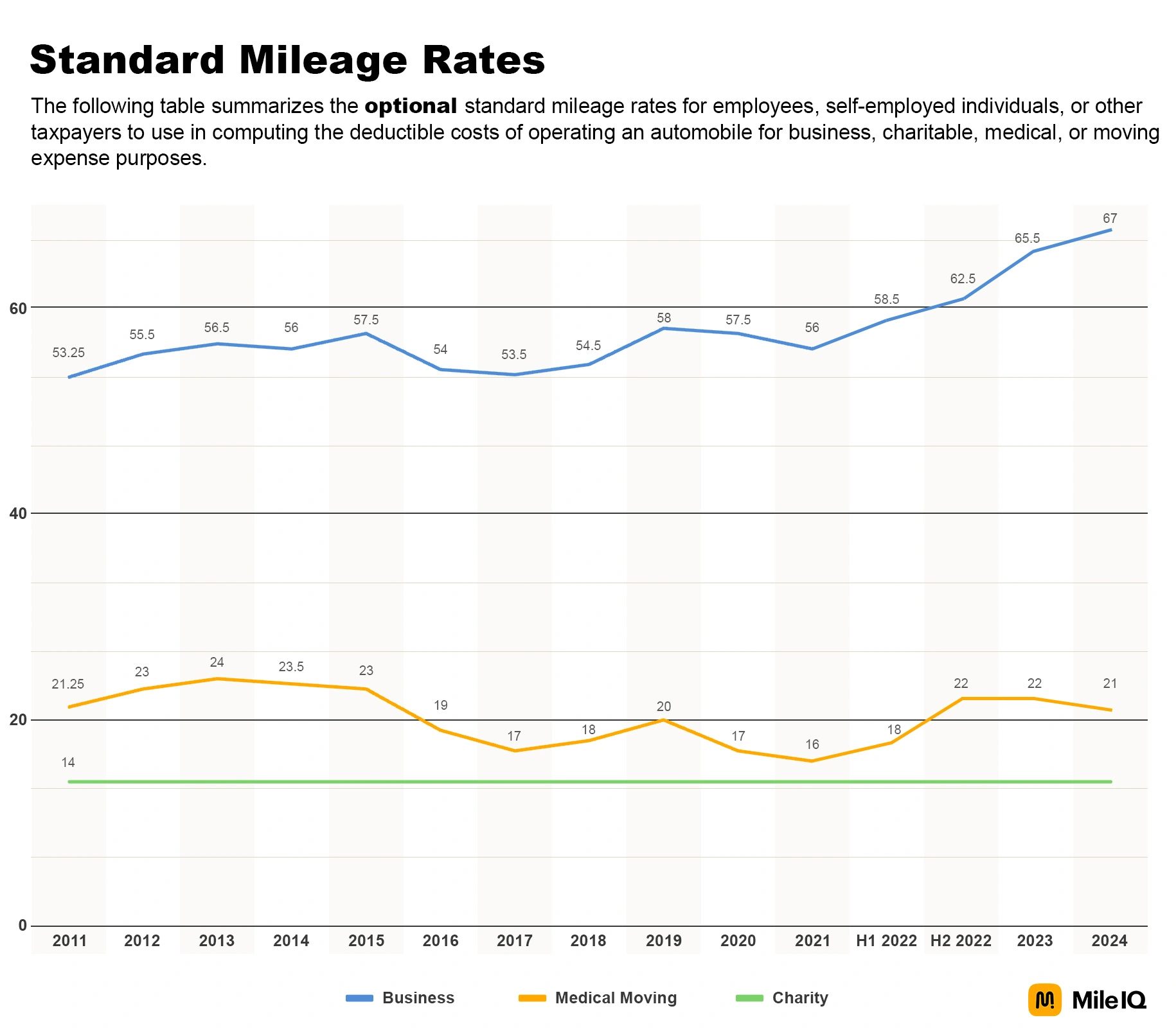

Those standard rates are subject to yearly change. In a few cases, they would even change mid-year. In the following chart, you can see how they have changed since 2011.

And finally, there are slightly different rules for businesses and self-employed.

Mileage Deductions Rules for Self-Employed

As a self-employed freelancer or a contractor, you can deduct mileage for business-related travel from your primary place of business. This can be an essential part of your business expenses, which you typically report on Schedule C of your individual tax return (Form 1040).

Eligible trips include traveling to meet clients, visits to secondary work locations, or journeys to purchase business supplies. However, it's important to note that commuting from home to your principal place of business doesn’t count as a deductible expense.

The standard mileage rate for self-employed workers of $0.67 per mile considers not only gas but also expenses like lease and depreciation. That’s why, in addition to mileage, you’ll need to add information about the vehicle you’re using.

Business Mileage Deduction

General rules for mileage tracking and tax deductions in the case of businesses are quite similar, but there are a few nuances compared to self-employed individuals.

In a small business with employees, the business owner and employees may have separate rules for mileage deductions. Business owners may deduct mileage related to business activities, while employees may be eligible for reimbursement of business-related mileage.

Depending on the type of business, there’s also a difference in reporting. For example, partnerships use Form 1065, S corporations use Form 1120S, and regular corporations use Form 1120.

And finally, businesses must keep records and proven mileage for every employee reimbursement and deduction they make.

Documenting Your Drives for Tax Deductions

As with any IRS-related procedures, claiming mileage deductions requires thorough documentation. It goes beyond merely knowing the miles you’ve driven; it’s about solid records supporting your claims.

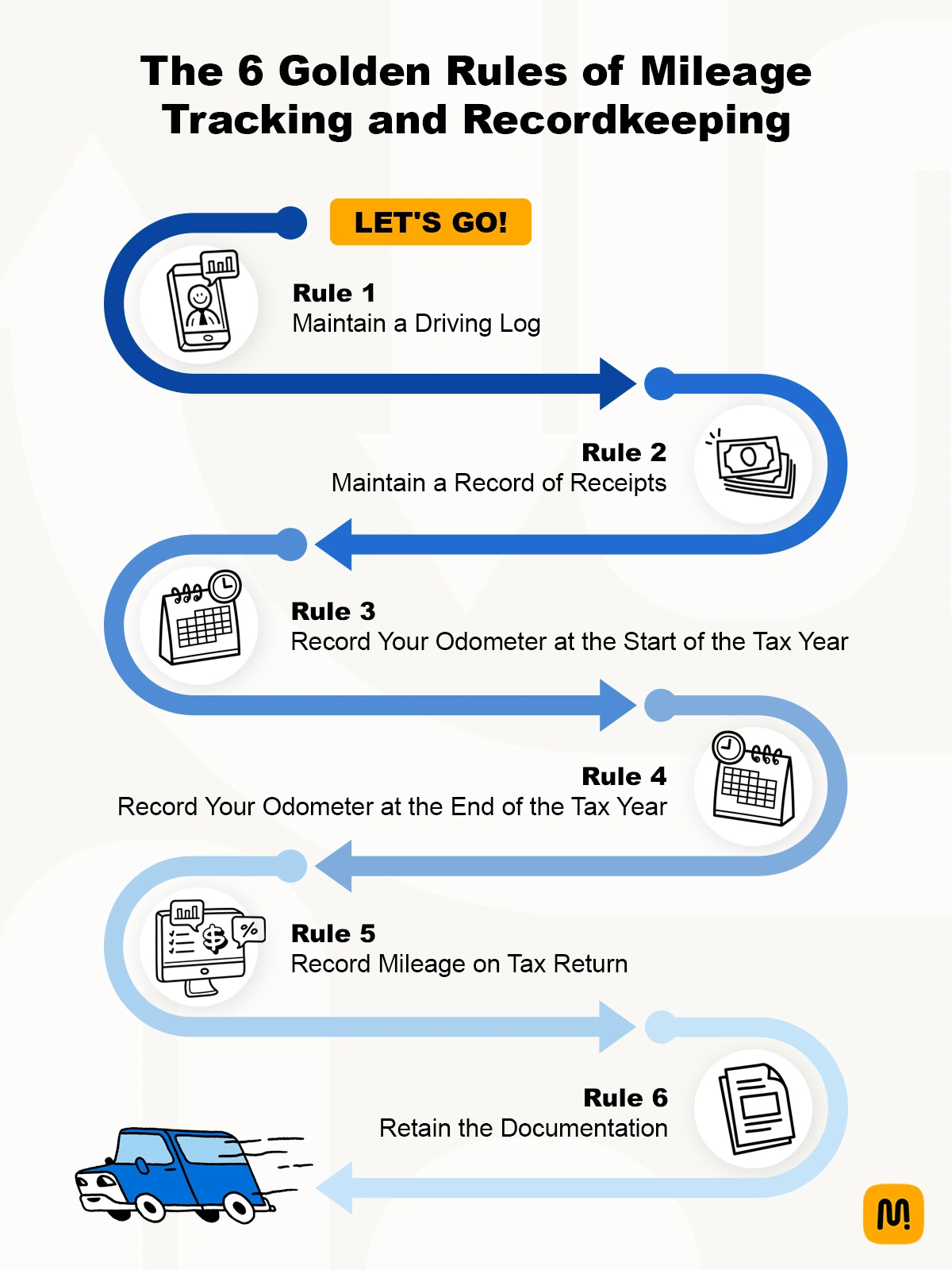

The 6 Golden Rules of Mileage Tracking and Recordkeeping below will help you always get the maximum possible deduction and ensure your documentation will be flawless.

1. Maintain a Driving Log

A driving log plays a vital role in mileage deductions. It includes the date, starting odometer reading, ending odometer reading, and trip purpose. Some examples of a valid trip purpose include:

- client visits

- delivering goods

- running errands

- business-related shopping

The IRS mandates precise and consistent maintenance of a mileage log. This means that you need to document every business trip, no matter how short or insignificant it may seem. Of course, as long as it actually is a business trip and you wish to get a tax deduction on it.

The more detailed your log, the better your chances of maximizing your deductions and staying compliant with IRS regulations.

2. Maintain a Record of Receipts

In addition to the driving log, you need to keep a record of all business-related expenses, like gas, parking, tolls, and repairs.

These receipts should include:

- The date of purchase

- The merchant’s name and address

- A description of the item purchased

- The amount of the purchase

Keeping these receipts will help you track expenses and may provide proof of these expenses in the event of an audit.

3. Record Your Odometer at the Start of the Tax Year

You should start each year by recording your odometer. This initial reading will be your baseline from which all other mileage for the year will be calculated.

It’s a simple step that can save you a lot of headaches in the long run. By having a clear record of your starting mileage, you can easily calculate your total business mileage for the year, making it easier to claim your deductions accurately.

Traditionally, drivers would use a log book or a spreadsheet to record odometer readings throughout the year. Nowadays, using an app like Mile IQ is much more convenient.

4. Record Your Odometer at the End of the Tax Year

Similar to noting your starting mileage, it’s equally important to record your ending mileage at the close of the tax year. This final reading is the capstone of your yearly mileage log, and it can help ensure you claim every mile you’re entitled to.

So, whether you’re using your vehicle solely for business or mixing business with personal use, ensure you note that odometer reading as the year closes. It’s a simple step that can make a big difference in your tax return.

5. Record Mileage on Tax Return

After gathering all your mileage data or receipts, the next step is to include your mileage or costs on your tax return. You can claim either the standard mileage deduction or deduct your actual expenses.

If you choose the standard mileage deduction, you’ll only need to provide total miles driven for business purposes.

The actual expenses method requires you to report each individual expense for gas, parking, tolls, repairs, and depreciation.

6. Retain the Documentation

Once you’ve claimed your deductions, remember to retain all your documentation, including driving logs, receipts, and odometer readings, for at least three years. During that period, the IRS may audit your tax return and request proof of your business mileage.

Of course, as long as your records are intact, organized, and readily accessible in case of an audit, you can feel perfectly safe.

Calculating Your Mileage Tax Deduction

Once you have all your documentation in place and all your business miles from the entire year identified, you should be ready to calculate your tax deduction. All that’s left is to choose the method.

The standard mileage rate method is simpler and requires less recordkeeping. Instead of tracking actual expenses such as gas, maintenance, and depreciation, you only need to keep a log of the miles driven. The formula for the method is:

Deduction = Total Business Miles * Standard Mileage Rate ($0,67).

The actual car expense method involves totaling all your car expenses, such as maintenance, repairs, and gas, and then deducting this amount from your taxes as vehicle expenses. It requires you to keep receipts and records for all the expenses as mentioned above. Then, you need to calculate the percentage of total miles driven that accounted for business purposes.

For example, if you have driven 10000 miles over a year and 2500 of them were for business purposes, your business use percentage is 25%.

Unlike the standard mileage deduction, it allows for a more tailored deduction based on specific costs incurred. However, once you choose to use the actual expenses method for a leased vehicle, you must continue to use that method for the entire lease period.

The formula for the actual expense method is:

Deduction = Total Actual Expenses * Business Use Percentage.

When deciding between both methods, you should evaluate your circumstances, including the amount of business use, the cost of operating the vehicle, and even your recordkeeping ability.

Preparation for Audits and Compliance with Tax Deductions

Even if you’re perfectly confident about your documentation, it’s good to be prepared for potential IRS audits.

The IRS may require you to provide a log confirming the business use of your car and a mileage log detailing the number of miles traveled for business purposes. Therefore, you must keep all your documents safe and organized and ensure that your mileage log is accurate and up-to-date.

Methods for Tracking Mileage

The traditional method of mileage tracking is a manual log, and it can still be viable. It’s an easy and quick way to keep track of your mileage, as long as you don’t have much to track.

However, keeping records manually comes with a risk of errors, such as miscalculations, incomplete entries, or unintentional omissions. It also becomes much more cumbersome if you have more trips and expenses to record. And, of course, being a physical thing, you can simply lose your mileage log at some point.

On the other hand, we have tailor-made apps designed specifically for the purpose of tracking mileage.

Apps like MileIQ make the entire process significantly more convenient, time-efficient, accurate, and consistent. The application automatically tracks your trips, which you can then classify as business or personal with a single swipe. Then, it keeps all your records for you and prepares a report for your tax deduction form.

Leveraging Technology for Mileage Tracking

Utilizing technology for mileage tracking is remarkably easy nowadays. Using apps, you can not only track your mileage but also:

- Generate IRS-compliant reports

- Ensure accurate and comprehensive data

- Provide automatic tracking for enhanced accuracy

- Create digital logs that distinctly document business mileage

It’s a simple way to make tracking mileage less of a chore and more of a breeze.

Common Mistakes and How to Avoid Them

Despite diligence, errors can occur. When it comes to tracking mileage, common mistakes include:

- Omission of the business trip’s purpose or wrong classification of a trip

- Reliance on estimates or approximations for mileage instead of accurate calculations

- Incomplete or inaccurate documentation

To avoid these pitfalls, always remember to:

- Document every business trip, no matter how short or insignificant it may seem.

- Aim for accuracy in your mileage logs.

- Ensure all your records are complete and accurate.

By doing so, you can avoid potential complications with the IRS and maximize your tax deductions.

Are You Ready to Fully Claim Your Mileage Tax Deduction?

It’s been quite a trip through the world of mileage tax deductions. We hope it was quite enlightening, and now you can consider yourself an expert on the topic.

So, whether you’re a self-employed worker or a small business owner, don’t overlook the importance of tracking your mileage. With a bit of diligence and organization, you can ensure you’re getting the most out of your tax deductions.

Still tracking miles by hand?

FAQ