This year is expected to produce an increase in corporate travel as employees return to in-person roles. Notably, driving for business never experienced the same type of drop-off as going to the office: our data shows after a slight dip in 2020, business driving remained constant from 2021 forward. These trends point to business travelers needing automated and easy-to-use tools like MileIQ to take full advantage of available reimbursements for tax deductions. The increase in corporate travel is a leading indicator that driving to meet with customers and building personal relationships will only rise as we continue forward post-pandemic.

MileIQ, the app that tracks mileage for you

MileIQ eliminates the guesswork and tracking issues that come with using paper mileage logs and spreadsheets for business drives. With over 100 billion miles logged and more than $10 billion reimbursed to our million-plus active users, MileIQ saves time by automatically tracking miles, enabling users to be reimbursed for their various work-related commutes.

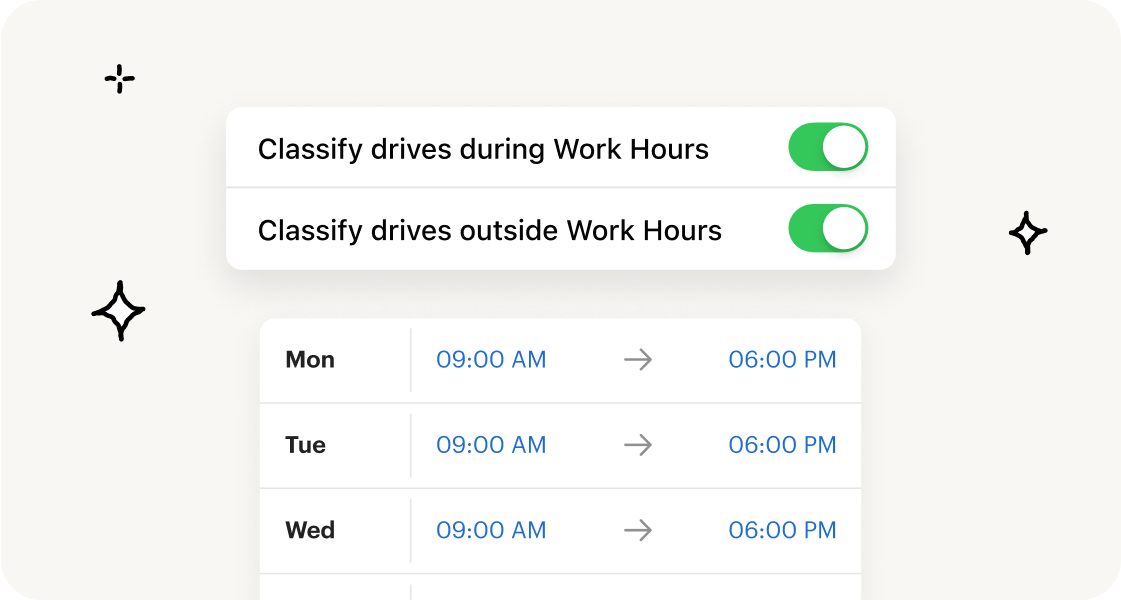

After downloading and setting up the MileIQ app, drives are automatically recorded, and users can easily classify drives as personal or business instead of estimating how many miles have been driven for business purposes throughout the week, month, or year.

Using MileIQ

If you utilize your car for work-related travel, as in, you travel from location to location on the job, you are likely eligible for deductions from the IRS or reimbursements from your employer.

By classifying your drives with a single swipe (swipe left to label a drive as personal or swipe right to label a drive as a business drive), MileIQ enables you to submit tax-compliant mileage reports with a single tap.

Types of drives that qualify for reimbursement include:

- Trips between offices or workplaces

- Meetings with clients, including meals and other cases

- Driving to a temporary job site outside of your permanent work location

- Drives for picking up business supplies

- Driving to the airport for business-related travel

Between rising gas prices and inflation, MileIQ is paramount for drivers seeking an automated way to correctly log their miles driven for work. MileIQ saves five minutes per drive compared to manually logging miles. MileIQ enables users to put money back in their pockets faster.

Empowering teams for a travel increase

For business teams, MileIQ allows team members to easily log their drives and submit accurate driving reports straight from the app. The MileIQ dashboard makes it seamless for teams to invite team members and managers to the app, set custom mileage rates, distinguish locations that teams visit frequently, and, if needed, connect with our support team. When using MileIQ, drivers save, on average, 80 hours annually by having their drives automatically logged.

This year, instead of manually logging your miles driven for work, utilize MileIQ for yourself or your team to simplify mileage tracking. Let MileIQ do the work for you so you can focus on getting your work done and, in turn, being correctly reimbursed for work-related drives.